General

Contract Specification - Spot FX and CFDs

Download Document1 lot for FX = 100,000 units

1 Oil contract = 100 barrels

1 XAU contract = 100oz

1 XAG contract = 5000oz

1 CFD contract = Underlying Market price

Unfortunately we are unable to accept US clients

PhillipCapital UK Operating from 8am - 6pm, any urgent matter after operating hours, please send an email to [email protected] and we will get back to you as soon as we are available.

To find out the individual margin requirements, please see the contract specification table on the FX, CFDs or Commodities page.

The Financial Services Compensation Scheme (FSCS) is the UK's compensation fund of last resort for customers of authorised financial services firms. If an authorised firm becomes insolvent or ceases trading, the FSCS may be able to pay compensation to its customers. As an investment firm, PhillipCapital UK’s clients would fall under the 'investments' claim category, whereby the cover is £50,000 per person per firm. So, if a client held an account with us and, in the event of the firm’s failure, there was a shortfall in segregation, they might be eligible to receive up to £50,000 in compensation from the FSCS.

Financing And Charges

Your funds get transferred to the bank details provided by yourself through the MyPhillip login. You may be asked to verify bank details.

You can request a withdrawal through your MyPhillip area or by calling us on +44 (0)207 398 3100

You can top up your margin by depositing funds with PhillipCapital UK. You can do this through the MyPhillip portal or by calling us on +44 207 398 3100 or email us [email protected]

You can top up your margin by depositing funds with PhillipCapital UK. You can do this through the MyPhillip portal or by calling us on +44 207 398 3100 or email us [email protected]

Minimum Standard Account $2,000

Swaps are the cost or benefit of holding an FX position overnight. They are based on the prevailing interest rates of the currencies traded. These are displayed as debits or credits on your MT4 terminal under the "Swap" column in the "Trade" panel.When you enter an FX trade, you are essentially borrowing one currency to buy another. If you buy GBPUSD, you are borrowing US dollars to buy GBP, therefore paying interest on the dollars you borrow but earning the interesting on the GBP bought. This results in either a charge on your overnight positions if you are borrowing a currency that has a higher interest rate than the one you are buying or a receipt if the currency you are borrowing has a lower interest rate than the one you are buying.

Financing charges are the cost or benefit of holding a CFD position overnight. These are displayed as debits or credits on your MT4 terminal under the ‘Swap’ column in the ‘Trade’ panel.

Deposits

Please see the Safety of Funds page of our website for all the relevant details regarding the protection of your funds.

If your deposit has been declined, you are advised to contact your bank/ card provider immediately.

Deposits received by bank transfer outside normal business hours will be processed on the following business day.

Payments by Debit Card are made through your MyPhillip area and are linked to your account. For payments made by bank transfer, you will need to reference your payment with your trading account number.

Where we receive notification that funds have been transferred, either by debit card or bank transfer, you will receive an email confirmation. When the funds have been received by us, you will receive a further email confirming that the funds have been applied to your account and are available for trading. We automatically receive notification of payments by Debit Card. If you wish to notify us of a bank transfer, you can let us know either by telephone or through the MyMoney page on your MyPhillip. By notifying us in advance of a bank transfer, we will be able to apply the funds to your account as soon as they are received. It should be noted that deposits received by bank transfer outside normal business hours - 09:00-17:00 London Time - will be processed at the earliest opportunity the following business day.

Many banks and card providers have processing fees for transferring money. Where these have been applied, PhillipCapital UK will pass on the relevant charge. We do not charge any additional fees.

Withdrawals

Your margin requirement is the sum of margin required to be held in relation to open positions across your account. Our current margin requirements can be found on our Product page under Contract Specification.

To change your bank account, login into your MyPhillip, select “Register/update Your Bank Details” and complete the form with your new details. You may be requested to provide further information to verify your new account details.

If you have not received your funds in a timely manner, please contact your relationship manager or a member of the helpdesk.

No – we will only return funds directly to you

No - PhillipCapital UK will only return funds in the base currency of your trading account. Your bank is responsible for converting the payment back to the currency of your account. If you need any further information, please contact your relationship manager or a member of the helpdesk.

We will endeavour to process all withdrawal requests as speedily as possible. However, the receipt of your funds is affected by many factors, including the payment method selected, your location, your own bank’s procedures and any other checks which need to be completed.Payments are normally received within 5 working days.

Risk

No, netting is not allowed across trading accounts.

If you are having problems topping up your margin, you can reduce your position to restore your margin level back above 100%. Should you have any issues topping up or closing positions, please speak to your relationship manager or a member of the helpdesk.

If you are on margin call, you risk your open positions being closed at any time. We may allow you up two business days to take action to restore your margin level back above 100%.

You can increase your margin at any time by depositing funds with us.

If your margin level falls below 100%, you will be sent an email alerting you of this fact. Your account information on MT4 Desktop will also be highlighted in red. If your margin level remains below 100% at 4pm London Time, you will be placed on margin call and you will be required to take action to restore your margin level to above 100%. While your margin level remains below 100%, your open positions may be subject to closure under our terms and conditions. If your margin level falls to 50% or below, your open positions will be automatically closed, starting with the largest loss making trade.

MT4 Desktop Platform (Real Time)

MT4 Mobile Platform (Real Time)

My Phillip Account (30s Update)

You can also contact your relationship manager or a member of the helpdesk.

Trading Platform

MT4 - How to add an indicator

With its user friendly interface and expert charting tools, MT4 allows for a simple, easy and reliable trading experience. This video guide shows you how to add an indicator to your chart.

MT4 - How to view an order

With its user friendly interface and expert charting tools, MT4 allows for a simple, easy and reliable trading experience. This video guide shows you how to view/edit/cancel an order.

Add a symbol to your Watch list/View Product Specs

With its user friendly interface and expert charting tools, MT4 allows for a simple, easy and reliable trading experience. This user guide shows how to add symbols to your watch list and how to view product specifications.

MT4 - How to place a trade

With its user friendly interface and expert charting tools, MT4 allows for a simple, easy and reliable trading experience. This short video guide shows you how to place a trade on MT4.

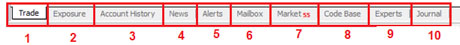

Section 7 - Terminal – has several functions where clients can view trades, news, account history, alerts, internal mail, program and expert advisors log.

- Trade - Details of open positions and pending orders, allowing clients to manage all trading activities. Please see below for a detailed guide to the Trade tab.

- Exposure – This tab contains the summary of the current exposure by asset (Symbol) type.

- Account History - History of all performed trade operations and balance (deposits and withdrawals) excluding current open positions.

- News - All financial news incoming to the terminal from Market News International can be viewed from this tab.

- Alerts - Clients can set and view alerts in this tab.

- Mailbox - Incoming/outgoing emails are stored here.

- Market – This tab connects the users with the MQL4 programs that allow users to buy trading tools such as indicators etc.

- Code Base – Allows the client direct access to the various codes published on the MQL4.community allowing clients to download codes and attach it to the tick charts straight away.

- Experts- Information about functioning of the attached experts, including opening/closing of positions, order modifying, the expert's own messages are published in this tab;

- Journal - Information about the terminals events during its operation, including all trading operations performed.

Trade Tab (Detailed)

The trading tab contains information about the current status of the account. It lists open positions along with account balance, margin, free margin, equity and unrealised profit and loss.

- Order – Unique MT4 ticket ID.

- Time – Time that the position was opened. (Year.Month.Day.Hour.Minute)

- Type – This describes the type of trade, whether it was a buy or sell, or a Sell Stop/Limit, Buy Stop/Limit in the pending orders list.

- Size – The size of the trade recorded in lots.

- Symbol – This reflects the name of the Symbol traded.

- Price - Price that the position was opened. This will be a static number and should not be confused with the second ‘price’ column in section 9 which is explained below.

- S/L (Stop Loss) – This will show the level at which a stop loss has been placed at. This column will show a zero value for positions and orders that do not have a S/L in place.

- T/P (Take Profit) – This will show the level at which a take profit has been placed at. This column will show a zero value for positions and orders that do not have a T/P in place.

- Price – This field will reflect the current price of the symbol traded. This will be updating as the price of the symbol moves and should not be mixed up with the static opening price seen in column 6.

- Commission – This will reflect the commission charges for clients who have a commission account. Clients who do not have a commission account, the field will reflect a zero value.

- Swap – Any charges for holding positions overnight will be recoded in this field.

- Profit – This column will reflect the profit or loss from the opening positions.

- Status Bar – This grey panel reflects the account balance, equity, margin, free margin and the margin level as well as the running profit and loss for the current open positions.

- Pending orders – Here you will see a list of the pending orders. The fields 1-9 above correspond to the pending orders section.

Managing trading activities through the terminal tab.

It is possible to manage your trading activities by right clicking on any open positions or orders in your trade tab in the terminal window. This will bring up the box to the right and will allow you to do the following functions:

- New Order – This selection will allow clients to open a new order and can also be accessed by pressing F9 (detailed description of the order window below).

- Close Order – This selection will allow clients to close a position only if the client has right clicked on an open order.

- Modify or Delete order – This option allows clients to edit or delete an order. The user can move stop loss and take profit levels. The user will be notified if the levels are too close to the market price and prompt them to be changed.

- Trailing Stop – By selecting trailing stop, clients can place/edit and delete any trailing stops on their open positions/orders. Trailing stops are set by points. For example a trailing stop of 50 points is equivalent to 5 pips.

- Profit – This give the client the ability to choose how their profit and loss is depicted in their terminal window. The client can select points, term currency or deposit currency.

- Commissions – This gives the client the ability to display or hide the commission column.

- Comments – This gives the client the ability to display or hide the comments column. This field will display any comments made by the client when a position is opened or an order is placed.

- Auto Arrange – With auto arrange enabled, when the client changes the window size, the columns arrangements will automatically alter to fit the window size.

- Grid – This gives the client the option to add or remove the grid column dividers.

New Order Window

Below is the new order window which can be access by ‘Tool>New Order’, pressing F9 or by right clicking on a symbol in the market watch and selecting ‘New order’.

- Symbol – This field gives the client the ability to choose what symbol they want to trade/make an order for.

- Volume – Clients can select the quantity they require. This is measured in lots.

- Stop Loss – Clients can enter there stop loss before placing a trade or pending order.

- Take Profit - Clients can enter there take profit before placing a trade or pending order.

- Comment – Clients can enter a comment regarding a trade (maximum 27 characters).

- Type – This drop down gives clients the choice of a market execution or place a pending order.

- Bid/Offer – This shows the current bid and offer for the selected currency pair.

- Sell – By selecting sell, the client’s market execution or pending order will be a sell trade.

- Buy - By selecting buy, the client’s market execution or pending order will be a buy trade.

Expert Advisor Testing

Tester Window – This window is used for the testing of expert advisors and allows the user to optimize the parameters. The ‘expert’ is tested on the historical data in order to work out its profitability. It can be opened from the main task menu by selecting ‘Strategy’, or by using Ctrl + R.

- Settings – Allows the client to alter the settings of the expert advisor.

- Results – Details the results of the trading activity performed by the expert advisor as well as reflecting any changes in account balance due to realised profits/losses.

- Graph – Shows the results of the expert advisor in a graph format.

- Report – An extensive detailed report of the expert advisor including efficiency, profit and loss, the most profitable and unprofitable trades etc.

- Journal – Record of all activity logged in chronological order.

Section 6 - Tick Chart – Basis of data analysis. MT4 graphs record price changes and allows various analytical objects to be placed onto the chart including line studies, technical and custom indicators, texts and geometrical figures. Up to 99 charts can be open at a given time. New windows can be opened by selecting ‘File>New Chart’ or ‘Window>New Window’  or by selecting the graph button on the tool bar . New charts can also be opened form the market watch window by dragging a symbol into the chart area.

or by selecting the graph button on the tool bar . New charts can also be opened form the market watch window by dragging a symbol into the chart area.

Inserting Indicators onto your Chart

It is possible to place various analytical objects into our MT4 graph by selecting ‘Insert’ from the Main Menu Tab. A drop down list of the various indicators, lines, shapes etc will appear.

Or you can enable the line studies by selecting View>Toolbars>Line Studies and the standard line studies tool bar will appear below the main menu:

Saving a chart Template

It is possible to save chart parameters so they are stored in memory allowing the client to gain access to their preferred chart parameters.

Cleints can access the templates by selecting >Charts>Template from the main menu or by right clicking on the chart area and selecting ‘Template’. Below are the options the client will see:

- Template – Selecting template will expand the template options below.

- Save Template – Having set the chart up with the clients preferred parameters (indicators, candle types etc), it is posisbl to save the template by selecting the save option.

- Load Template – Load template will allow the client to search their compute for saved templates.

- List of Templates – The drop down box will list a set of predetermined templates as well as any saved templates the client has used.