The Hang Seng Index, the city's 50-year-old benchmark, it’s down 11% for the year and the cheapest on a record price-to-earnings basis. Last month it suffered the worst quarterly drop versus the S&P 500 Index since the Asian financial crisis in 1998. On the other hand HKEX, the firm that operates the stock exchange, is the second-biggest of the world, second only to Chicago’s CME Group. It’s the priciest exchange, trading at 40 times price-to-earnings, having a 60% premium to peers. The stock is up more than 40% in 2020. With two of the most straightforward ways to bet on the future of a stock market telling opposing stories, investors are getting very mixed signals.

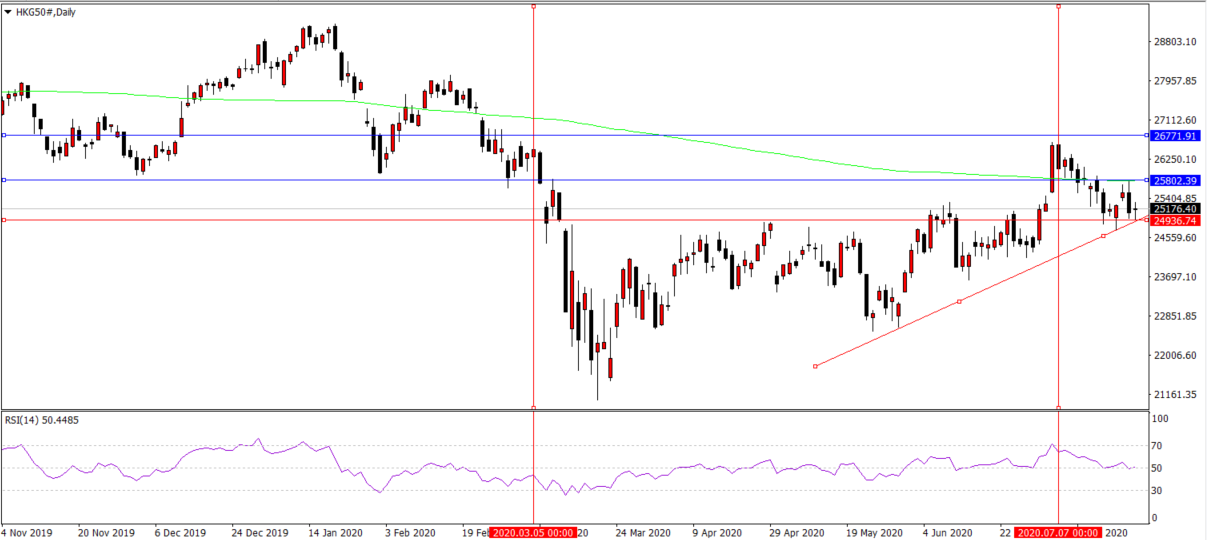

The index returned this month to early-March levels breaking through the 200-day average but fell swiftly following US-China tensions and is now trading in a tight-range between 25802 and 24936.