Gold buying gathered more force as prices were driven higher into record territory above $2,000 an ounce as investors assessed prospects of more stimulus to combat the pandemic’s fallout, another slide in US real yields and increased geopolitical risks.

Bullion is up more than 30% this year, and could extend gains as governments and central banks respond to slowing growth with vast amounts of support. The safe haven’s allure as a store of wealth is strengthening as investors face the prospect of a long global recovery, and the debasement of fiat currencies.

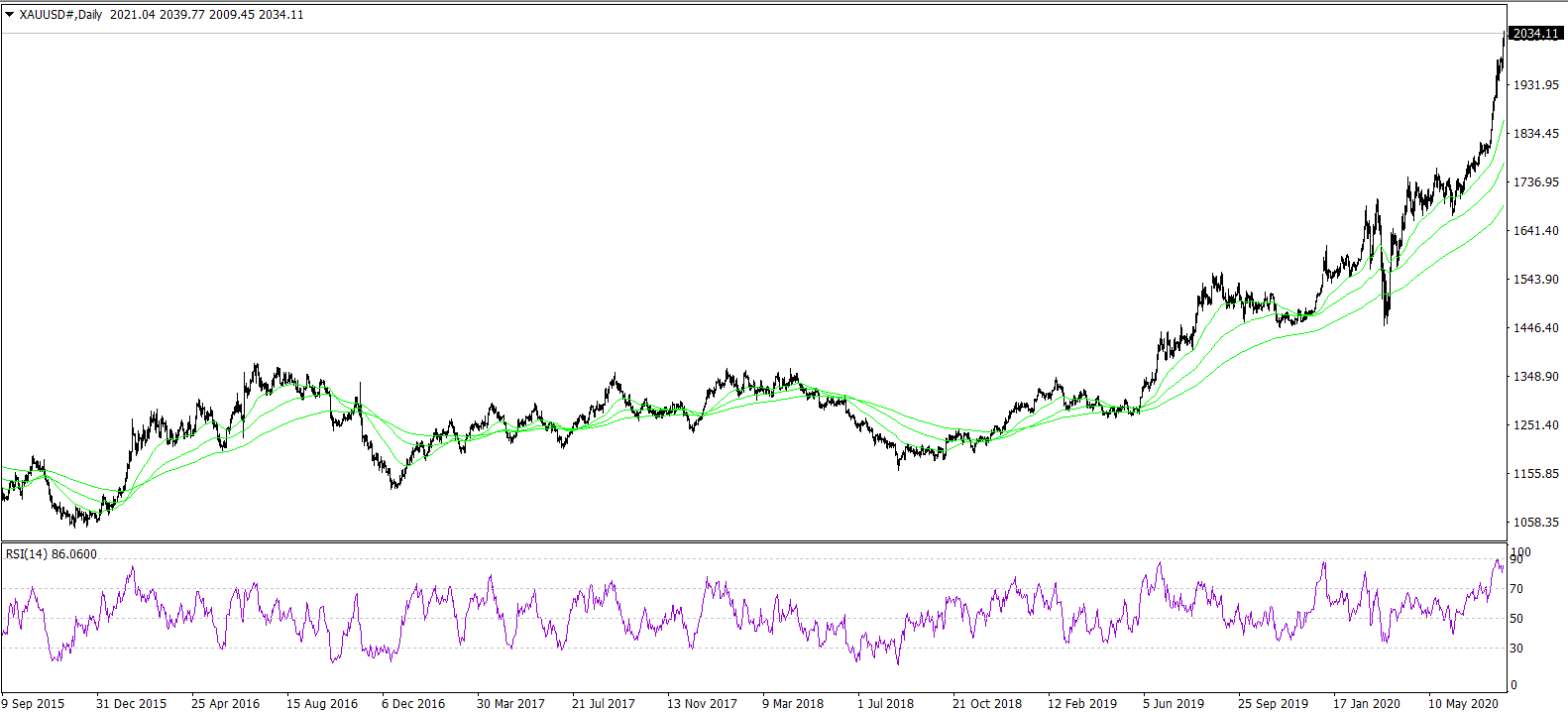

RSI remains near 90, showing highly overbought levels of a one-sided market and diverging EMAs.